I am definitely not the first one to write anything about cryptocurrencies and I am not the one eligible to write one at all. Yet I am persuaded to write this up. So there’s this fad going around cryptocurrencies and people who never have known about computer algorithms now want to buy and sell them, in the hopes of making a quick fortune. Do all of them understand what cryptocurrencies are and how they work? I am not sure. But I definitely don’t.

Currency is a medium of exchange of any value. It is the thing everyone values and everyone wants. Well, that’s the concept. But making this medium of exchange into a physical form is not that easy. The difficulty is in making sure nobody will be able to create a currency out of anything and falsely claim value for it. One workaround is to use things that are precious and rare as currencies. But since they’re rare, there won’t be much of them for everyone.

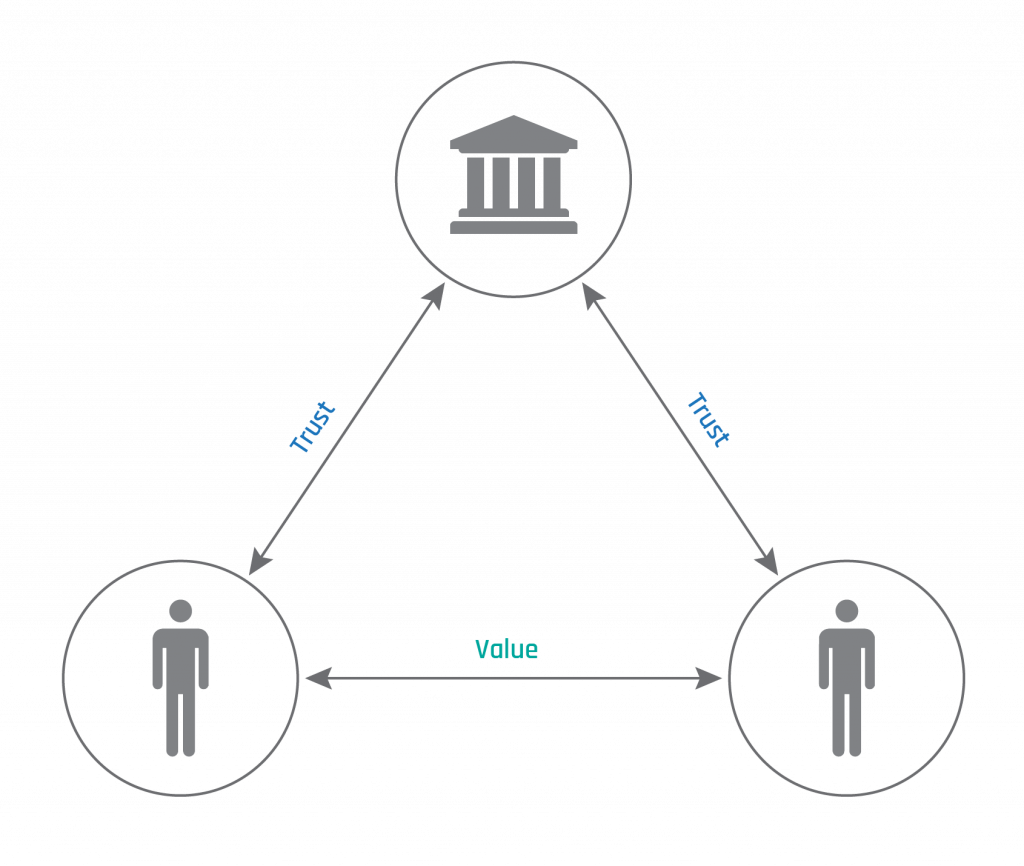

The solution is to use something that has a consistent form and recognize it as valuable based on mutual agreement. That basically is trust. So a currency is a medium of exchange of trust. But who trusts who? Can trust be distributed? Can there be a central entity that everyone can trust?

The second one happens to be the type of currency we use today. Because law is something that everyone can trust and agree with, at least democratically. This makes it possible to form a central body under the overseeing of a government. Through this entity, we get two assurances,

- The assurance that the central body itself is trustable.

- The assurance that anyone who trusts the central body is also trustable.

The central body has to be small, while the trustees can be of any size. This is how our money works?

The second one must not have started until we found a way to independently verify trust. Verification of trust is verification of integrity, or more simply order. This could only be achieved mathematically without any chance of randomness. Because randomness is uncertainty. Uncertainty is unpredictable and the outcome is only apparent when we interact with it. When interacted with, uncertain systems create information out of nothing, such as the position or momentum of a particle. But why this has to be the case? Why can’t universe have pure order everywhere? Then the mathematics would perfectly fit in right? Or is it the mathematics the root of this behavior? Woah hold on a minute. Where are we going? That’s stuff for another post. Let’s stick with currencies for now.

The central body is whom everyone can trust. It assures and verifies the value of everything. This is done through the exchange of money. When two individuals can trust this central body, they can exchange value between them – what we call a transaction. Trust is implicitly present in the transaction of money.

This makes it easier for people to exchange values they generate. The value of currency is determined by demand and supply and the central body has control over this rate of value.

In a distributed trust scheme, both trust and value are distributed and they are directly exchanged between anyone involved. In cryptocurrencies, this trust is verified mathematically through the verification of ownership. No central authority has control over the value of the trust exchanged. Or in other words, everyone has the authority to define value. This makes it prone to the side effects of uncertainties and makes it difficult to do transactions, compared to central currencies.

Cryptocurrency is a distributed currency. It exchanges both value and trust. By design, it is a list of algorithmically verified list of electronic transactions. Think of it as a large book with all transactions everyone makes. This book is practically tamper proof – means nobody can alter a transaction once its entered and verified. The book is called a ledger. So who does the verification of transactions? We will come to that in a min.

Before that, let’s have a basic understanding of how the money we use in our everyday life is created and used. Banks are the entities that create money. Central bank creates money out of demand and trust. For external viewers, this is like creating money out of thin air, and they would be right. When a person or company approaches a bank with a business proposal that is assumed to create a certain profit for a certain duration, the bank trusts the business and creates new money for them in the form of loans. The central bank’s trust on a business becomes money.

The loan money is either electronically added to your bank account or lend out as physical money printed by the central bank. In both cases, central bank is giving you a legal declaration that they trust your business. When the business is successful and makes profit, they’re able to return the money back to the bank and thus the trust is verified and the money becomes valid.

But not all businesses become successful and profitable. But the central bank, being in control, can regulate this money making process, via different methods and keep the whole process balanced. The transactions the central bank does, and the transactions we all do everyday are different. When you send someone money, the transaction is simply a relocation process. Your money goes to somebody else’s account. From the perspective of the central bank, money just moved from one account to another. Money was not created nor destroyed.

The transactions processed by the central bank differ that it has to verify whether the money they created and lent out to businesses have been returned. This is the verification of trust.

Demand

↓

Trust

↓

Loan

↓

Profit

↓

Interest

That’s the chain of modern economy. What we just saw is the Centralized Banking System based on central currency system. What’s the alternative? Decentralized Banking System based on decentralized currency system.

Decentralized banking system consists of an open book of transactions that everyone can see and get a copy of. Not only you can get a copy of all transactions, but you can add your own transaction. But if you are able to add your own transaction, how would you tell everyone else that you have added one? 🤔

That’s where verification come into picture. All transactions in the open book have to be checked and verified by everyone who gets a copy of it. Verifying a transaction requires some form of effort. The effort required increases with the number of transactions you have to verify, or the size of the book. But worry not, the effort you make to verify transactions won’t go neglected.

Instead, you are rewarded with an incentive for making the effort. This will be in the form of a new credit transaction to your account. You just earned something for verifying transactions. How cool! All these processes can be carried out digitally. There are technologies to help with that. For example, the ledger is created as a Blockchain, the communication between chains are relayed through Peer-to-Peer (P2P), verification is done via Mining etc. Emphasized are the three important aspects of any cryptocurrencies. Every cryptocurrency is simply a bundle of the aforementioned technologies.

How each of the currency utilizes them can vary, but the underlying principles are the same. Let’s understand the technologies used for cryptocurrencies in simple terms.

Blockchain is a digital list of data. Each list item can be called a record. Each record is mathematically related to all the records existed before it. When you add a new record, you have to run a mathematical formula to calculate that relation. The mathematical functions used for such calculations are called Cryptographic Algorithms. This is why cryptocurrencies are known so.

Crypto algorithms are similar to the ones used in Encryption and Decryption. Encryption is used everywhere on the internet. When you type a message on WhatsApp, for example, the message is not sent plainly as it is. Instead, the message will be converted to a form that nobody else can read.

For example when my name “Vishnu” is encrypted, it would look like this

"oQRhINPVJj8pFzceDOxpaeCo0VZK/Y1RsFQ3jMsC8UA="

Can you read it? No. Cryptographic functions used for Blockchains produce a number called hash. Such functions are also called Hashing Algorithms. MD4, MD5, SHA256 etc., are some of the popular hashing algorithms. The SHA256 hash of the text “VISHNU” is,

"29ccf2105f217e26e67aa52ca299565ad46637a56561108f00e20d5ca804c29b"

You can try this on your own and the value will be same. You can find hash values for your name or any text here : https://emn178.github.io/online-tools/sha256.html. One use of Hashing Algorithms is to verify data integrity. For example, say I am sending you a 1GB file on a USB drive. The file is a text file containing all of our WhatsApp chat. I will ask one of my friends to deliver it to you.

When you receive the file on your side, how sure are you that the guy who delivered it did not see the messages and altered any of the conversations? One way is that I come to you and meet you in person. Then we both can verify nobody has modified anything. But if that was possible, why did I have to send it on a USB drive and ask my friend to deliver it? But if I am smart, I can generate a hash value of the 1GB file and send it to you secretly. The friend who is carrying the USB drive would not know the hash value.

When you receive the USB drive, you can generate the hash on your side using the same algorithm and check if it is the same one I have sent. If they’re both same, data is intact. But this does not prevent the carrier friend from reading the messages. You can use Encryption algorithms for that.

What I have just given is a most simple example of how Cryptographic Hashing Algorithms are used. A cryptocurrency blockchain will have transactions as records. Every transaction will include the information about who sent whom, how much, when etc. For example, Person A sent 0.05 to Person B on 5th May 2021, 4:35 PM IST. The whole crypto blockchain will have millions of such transactions. The current size of the Bitcoin blockchain is around 320GB. This data is not just kept in a single server, but a network of servers around the world.

The servers communicate each other via a Peer-to-Peer network. P2P is the same technology used for Torrent file sharing. The file you download comes from many decentralized severs with copies of that file. How this communication is carried out, how the transactions are verified and how the miners are rewarded are what a cryptocurrency architecture defines.

Bitcoin (BTC) is one such cryptocurrency. Then there’s Ethereum, Litecoin and the infamous Dogecoin 🐶 and more. Downloading the blockchain for a particular currency and performing cryptographic verification is called Mining ⛏️ Simply, you will use your computer to run cryptographic algorithms to find hashes. And you need a high performance computer for doing that. That’s when we talk about Graphics Cards (GPUs) 🔥 These are simply the pewwerrr.. of mining. Cryptographic algorithms run better and efficient on GPUs than normal CPUs. This is why crypto mining folks are so obsessed with GPUs and they can’t have enough.

Now to the important question. Where does cryptocurrency get its value from? A decentralized system does not relay on demand, can not create value arbitrarily, and has no legal assurance! Then how?

The only inherent value a cryptocurrency has, comes from how much effort was made to create it. For example this could be the money spent on mining hardware or energy charge spent on mining. But this value is futile. It does not produce any useful asset or make avail any services to the society, if not exhaust the resources. The practical value only comes when cryptocurrency can be exchanged for any goods or services. For example if I decide to sell cars for Bitcoin (BTC), then the coin suddenly gains value. How much BTC should a car cost totally depends on my decision.

Another possibility is being exchanged for any centralized currencies. All of existing cryptocurrencies rely on the assurance of a centralized currency, usually US Dollar. That’s an irony right? 😂

The rate of the exchange is what you see fluctuating everyday. When you hear Bitcoin is losing, it means the exchange rate is falling. You will need more BTC to buy certain amount of centralized currency. So what determines the exchange rates? Answer to that is Herd Psychology or Herd Behavior. Herd Behavior is what you will observe happening among a large number of people in the lack of a central authority.

A decentralized cryptocurrency has no central authority. Therefore, the exchange rate of the coin will largely depend how the owners of the coins collectively behave. This behavior is actually true for stock markets. But stock markets are backed by centralized currencies, and they actually rely on profiting businesses. Essentially, stock markets allow businesses to succeed or fail safely. People with large numbers of followers or “influencers” are able to literally manipulate the exchange rates of crypto currencies due to the herd behavior. This totally eliminates any rational thoughts or analytics based on performance – both of which are important in stock markets.

When you say investing in crypto currencies, you’re actually buying already mined coins. You’re not mining yourself. This makes it possible to buy cryptos for any amount of centralized currency. When you invest on cryptos, you are actually playing a gamble. You might be able to play it safe and make a short term profit. But you actually run the risk of losing it.

The more you’re investing, the more risk you’re undertaking. Even if you earned so much profit and did not convert it to centralized currency, there’s still no guarantee or legal assurance that it will hold its value. I would suggest to invest in stock market that actually helps businesses to grow and thus bring progress to the society. Invest in businesses you trust and grow together. Study the market, digest the analytics, predict future courses and invest accordingly.

But if you’re after some quick money and want to take risk, then invest some in cryptos. It can actually increase the chance of cryptos being accepted generally.

Disclaimer : What you have just read may or may not be true or up to date. This is not an advice on running businesses or making investments. Always refer to scientific studies and research, and consult with experts on these matters.